Source - State Insurance Regulatory Authority (SIRA)

Press the slider arrow above to see the updates

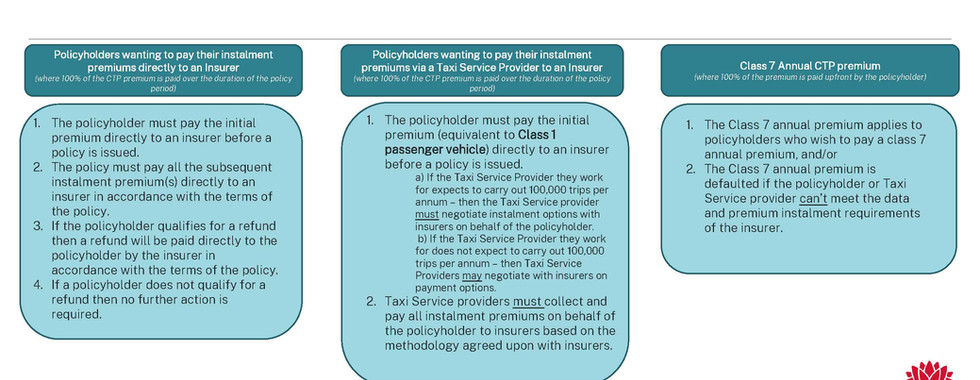

Taxi CTP Premium Options from 1st July 2023

Option 1 - Policyholders wanting to pay their instalment premiums directly to an Insurer (where 100% of the CTP premium is paid over the duration of the policy period)

The policyholder must pay the initial premium directly to an insurer before a policy is issued.

The policy must pay all the subsequent instalment premium(s) directly to an insurer in accordance with the terms of the policy.

If the policyholder qualifies for a refund then a refund will be paid directly to the policyholder by the insurer in accordance with the terms of the policy.

If a policyholder does not qualify for a refund then no further action is required

Option 2 - Policyholders wanting to pay their instalment premiums via a Taxi Service Provider to an Insurer (where 100% of the CTP premium is paid over the duration of the policy period)

The policyholder must pay the initial premium (equivalent to Class 1 passenger vehicle) directly to an insurer before a policy is issued.

If the Taxi Service Provider they work for expects to carry out 100,000 trips per annum – then the Taxi Service provider must negotiate instalment options with insurers on behalf of the policyholder.

If the Taxi Service Provider they work for does not expect to carry out 100,000 trips per annum – then Taxi Service Providers may negotiate with insurers on payment

Taxi Service providers must collect and pay all instalment premiums on behalf of the policyholder to insurers based on the methodology agreed upon with insurers

Option 3 - Class 7 Annual CTP premium (where 100% of the premium is paid upfront by the policyholder)

The Class 7 annual premium applies to policyholders who wish to pay a class 7 annual premium, and/or

The Class 7 annual premium is defaulted if the policyholder or Taxi Service provider can’t meet the data and premium instalment requirements of the insurer.

Next Steps for Taxi Owners and/or Taxi Service Providers (TSPs)

Insurers have been busy working through what their premium methodologies will look 1st of July 2023. They have been focussing on determining what their Taxi Model premium methodology will look like post the Guideline commencement. Up until recently insurers have been finalising their premium methodologies and CTP insurer filings in time for the 1st July and have not been ready to discuss their premium methodologies with Taxi Owners/TSPs until now. Insurers have provided a contact person to be the point of contact for all Taxi premium methodology enquiries and discussions, which has been provided in the table here - (click here). They ask that all Taxi Owners and/or TSPs wanting to have these discussions go through that point of contact so that they can appropriately and effectively triage this for the interim. Click here to find the contact details in the update shared by SIRA.

What Does This Mean For Me?

Taxi Owners and/or TSPs can start to reach out (if they haven’t already)to their existing CTP Insurer and other CTP Insurers to discuss what their new Taxi CTP premium methodologies will be from 1st July 2023 even if their CTP policies are not up for renewal

Insurers are open to Taxi Owners and/or TSPs reaching out to them to discuss their premium methodologies, reasonable data requirements and premium Insurers can at any future point submit new CTP filings, making changes to their premium methodologies (subject to SIRA’s approval), allowing for more flexibility, and innovation, providing opportunities for TSPs to discuss an insurer’s premium methodology and arrangements with them throughout the year.

Will I Be Disadvantaged If I Am a Smaller Operator Versus a Bigger Operator?

There is no disadvantage for smaller TSPs over Larger TSPs as a result of no insurer contact being made to

Insurers have provided the following CTP options: 1. Policyholders may prefer to purchase their CTP policy directly from the insurer, or 2. Policyholders may choose to purchase their CTP policy through their Taxi Service Providers

SIRA is continuing to monitor and work with all stakeholders to operationalise guideline changes, and monitor market competition. It is important to understand that these guidelines provide a framework for pricing equivalence, innovative premium methodologies, and flexibility and will continue to evolve.

Commentaires